The B2B Buyer Crisis: A Board-level imperative to fix GTM inefficiency

Reflections on the imbalance of power in B2B and how AI could help rebalance things

A critical issue is emerging that demands more attention at the highest levels of corporate leadership: the growing disconnect between B2B buyers and vendors, despite a market for enabling GTM technologies now in the hundreds of billions od dollars.

In the world of B2B, buyers today are facing a pack of eager vendors - each one promising to be the solution to their problems. But, buyers are increasingly unsure which door to open - or whether to open any at all.

(source: Dall-E)

This isn't about the inconvenience of waiting for reps after filling a Contact Us form or a new buyer wokeness —it's a fundamental issue eroding GTM efficiency, hemorrhaging sales, and making the B2B market inefficient.

This should be treated as a Board and CEO level issue. Let’s dig in.

New to the B2B buyer disconnect? Let’s zoom out

As a former CMO at disruptive AI startups, I’ve been fascinated by this topic because as buyers accelerate the shift to digital journeys, Marketing is at the center of this shift.

TrustRadius has been studying this topic for the past 7 years. When I first read the 2023 B2B Buyer Disconnect report and similar research by Gartner in 2023, these metrics immediately screamed for attention, given how shocking they are:

60% of technology buyers involved in decisions to renew or expand “as-a-service” agreements regret nearly every purchase they make, a 6% increase from 2020.

Buyers want 100% of the buying journey to be digital where possible

Conversations with reps now rank #2 from the bottom in useful resources

When the 2024 B2B buyers disconnect report dropped last month, it showed an even more altered landscape between buyers and vendors. I’ve summarized it below with a video highlighting some of my key observations.

Buyers are using short lists more than before with 2-3 names when they start - as proxies for trust. 71% of buyers reported going with the first product on their list

Buyers are relying on fewer resources than ever, and the only top-five resource that saw an increase year over year (YoY) was “own prior experience.”

50% of buyers are seeking out former colleagues or known peers to discuss options, 35% talk to coworkers, only 27% are using vendor-provided references

This means vendor provided information is #3 for buyers in their mental stack

Secular Drivers Behind the B2B Buyer Disconnect

Let's examine the key factors contributing to this chasm:

Information Asymmetry: Buyers now have access to vast amounts of information, often knowing more about the landscape than vendor GTM teams. They have thousands of thousands of data points across hundreds of tools

for e.g. just for CRM, G2 has 718 listings as of July 2024 and for Conversation Intelligence, G2 has 138. It’s impossible to hide bad products in the open.

Shifting Buyer Expectations from Sales: B2B buyers increasingly expect B2C-like experiences, personalization, immediacy, and seamless digital interactions.

experiences like Amazon and Uber and ChatGPT have increased our cognitive demands for instant gratification from any product

in consumer goods or D2C we hardly ever interact with sellers

Complex Buying Committees: The average number of stakeholders involved in B2B purchases has grown to 6-10 today, complicating decision-making processes.

this doesn’t include the influencers who are also rising in any buying organization who aren’t directly reflected in the org chart, ranging from digital officers to innovation teams

buying committees are also more diverse and sprawled than before

Trust Deficit: With the proliferation of similar marketing messages, buyers are increasingly skeptical of vendor claims and seek unbiased, third-party validation.

over claiming capabilities that don’t exist isn’t a new problem, but industries like cars and housing have objective third party comparison metrics vs say Gartner or Forrester in B2B which are relatively much more subjective

scan the top 5 websites in almost any product category and you would be hard pressed to not see similar phrases like “AI-first” “all in one” “unlock value”

Digital Delivery Challenges: Most B2B companies struggle to provide the digital experiences buyers expect because they have conflated digital marketing with just ad spend or programs, making them prone to thousands of digital droppffs daily

The reality is that most current web experiences are still offspring of glorified iFrames, with very little meaningful innovation on the actual user experience

From broken B2B buyer metrics to broken B2B seller metrics: A wake-up call for GTM

Let’s now look at the numbers above in the context of other seller-side metrics facing B2B leaders and CEOs today:

Plummeting GTM Efficiency: According to Forrester, the cost of customer acquisition has increased by over 50% in the last five years for B2B companies.

Meanwhile, conversion rates have declined by 30% on average.

Declining Sales Win Rates: SiriusDecisions reports that the average sales win rate has dropped from 47% to 43% in just two years, or millions in lost revenue.

Lengthening Sales Cycles: According to CSO Insights, the average B2B sales cycle has increased by 22% in the last five years, tying up resources and revenue.

B2B companies are spending more than ever to acquire customers, yet seeing diminishing returns from traditional approaches.

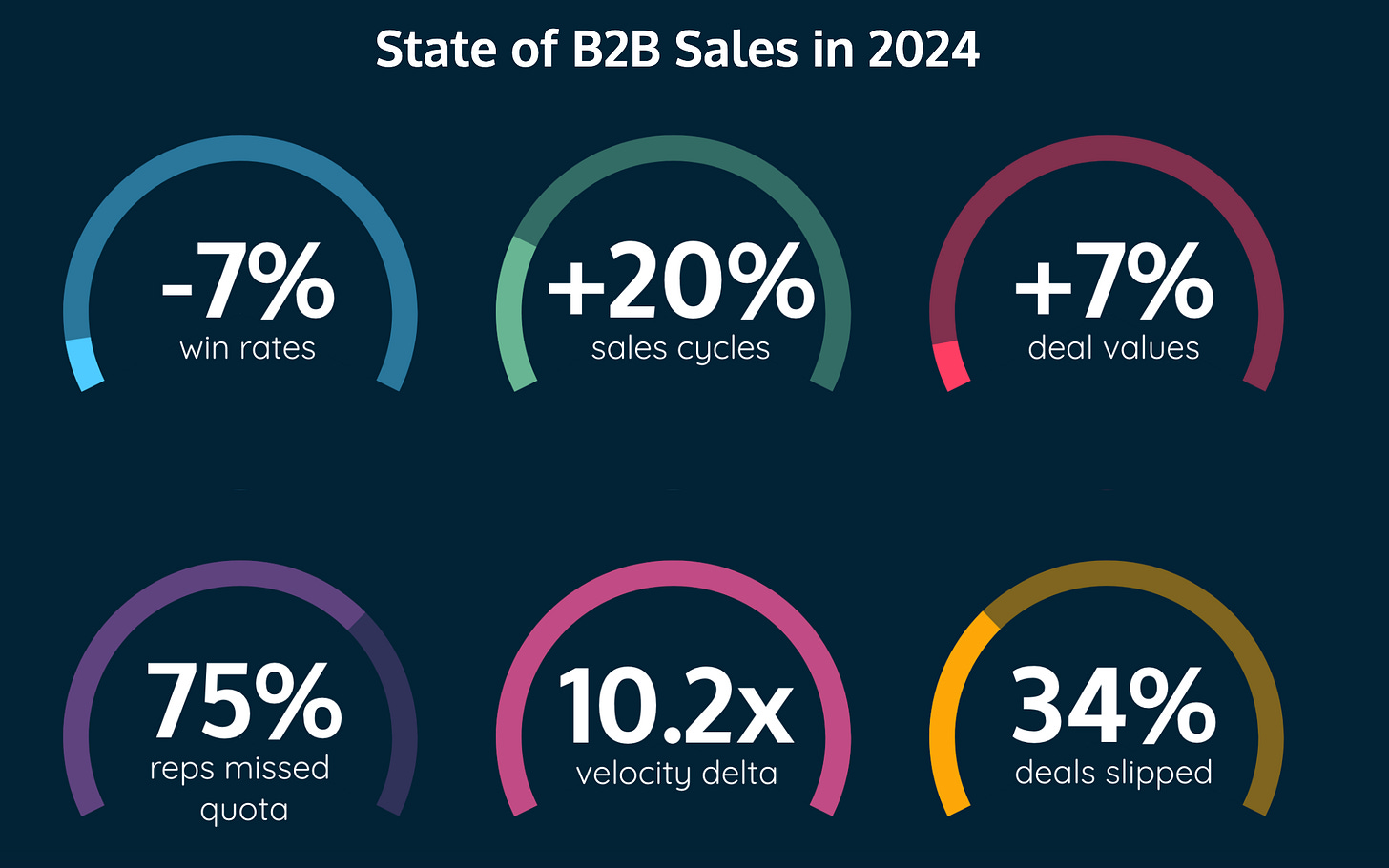

The graphic below from the Ebsta 2024 State of Sales report summarizes many other metrics which are WAY WORSE!

The traditional GTM playbook is failing and it isn’t enough to just let the CRO or CMO fix it. They haven’t been able to fix it for a while.

Serving the modern B2B Buyer should be top of mind to win in the AI economy

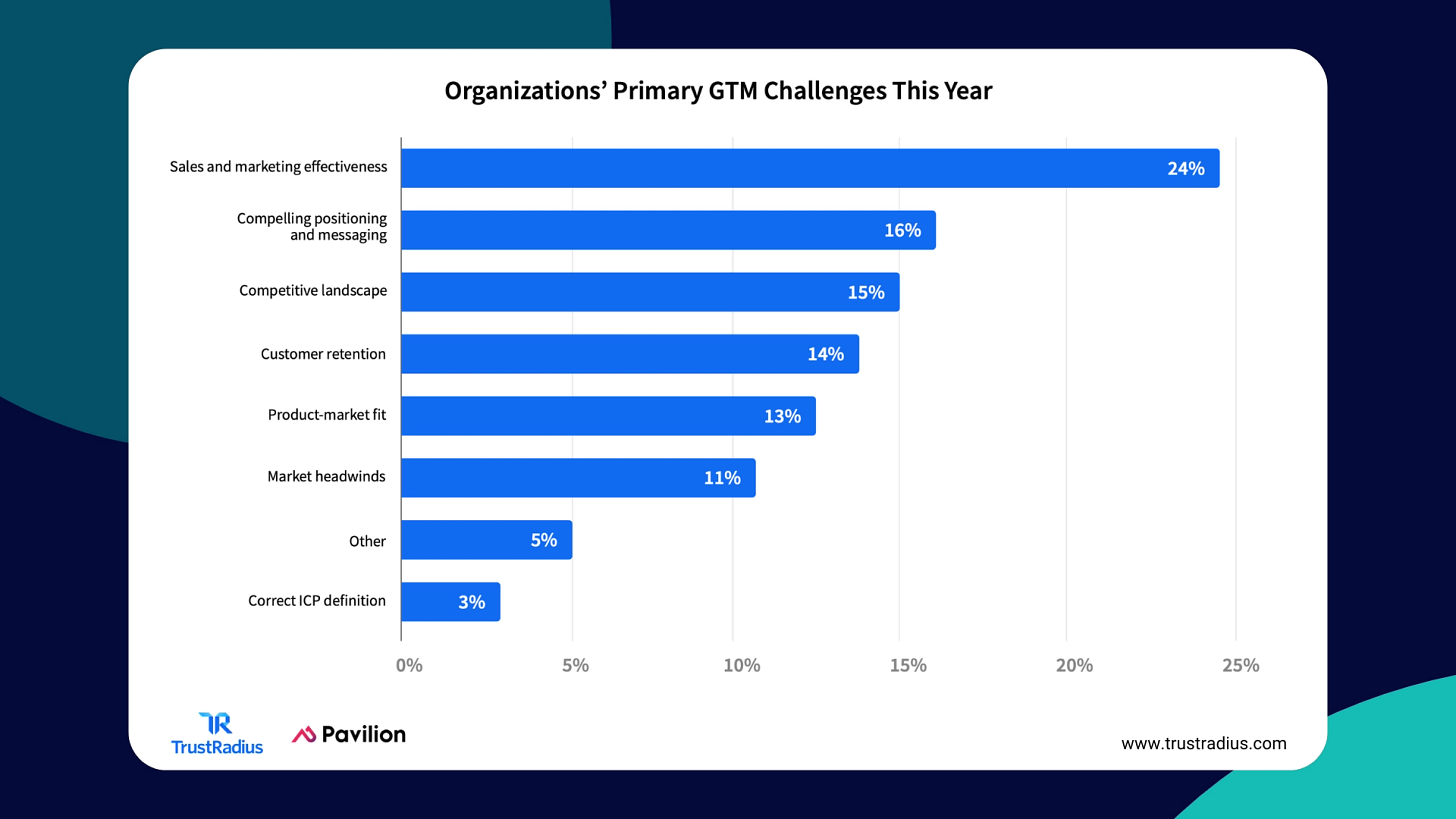

The B2B buyer disconnect is not merely a sales or marketing problem—it's a strategic misalignment issue that demands executive-level attention in the age of AI:

Financial Impact and Risk Management: Declining GTM efficiency and lost sales impacts the bottom line, profitability, growth rates, and valuations. With higher buyer remorse and churn in the AI products era, there's a growing risk of reputation loss and loss of market share for imcumbents and a risk of never ever being in consideration for the dozens of new products born in every category

Competitive Advantage from R&D vs GTM: If companies are spending nearly 2X on their GTM versus R&D, that will blunt their edge in today’s markets, especially in the AI economy which is hyper-accelerating innovation across every product and service.

Ideally, in an AI era, once you have product market fit, you should be able to more elastically scale your GTM to maximize the market’s revenue potential

Aligning Sales and Marketing using AI: With B2B buyers evolving at a much faster rate than B2B sellers, and top sellers in any domain being limited by demographic and psychographic factors, we are witnessing a fundamental shift in which only the most integrated Sales & Marketing teams will win. For companies to deliver value they need to fix Marketing & Sales to serve buyers 1:many to 1:1

The companies that will thrive in the coming years are those whose boards recognize the urgency of this issue and drive the necessary changes through their organizations.

Future outlook on the gap: How can AI help all sides of the marketplace win?

To address the growing disconnect, B2B companies need to fundamentally rethink their approach. Here are several strategies that can drive a compounding impact:

Invest in AI Like You Mean It: Seamless, omnichannel experiences that cater to buyers' preferences for self-service and digital interaction aren’t just words on slides. Show your users next generation experiences like they are used to at home

AI-Powered Personalization: Develop AI tools that can predict buyer needs and serve them through personalized buyer journeys that across channels and seamlessly handle the handoffs between automation and human engagement

Ecosystem Orchestration: Support and activate presence on neutral platforms that connect buyers, vendors, and partners in open collaborative ecosystems.

Vendr is a good example of a forum that shares market data and buyer trends

Outcome-Based Models: AI apps present an opportunity to shift towards outcome-based pricing and engagement that aligns vendor with buyer success, versus a one size fits all per user/per month type of traditional pricing model.

Focus on Post-Purchase Success with AI: Invest heavily in AI powered customer success and adoption tools to ensure end users achieve their desired outcomes, reducing potential competitive churn to metoo products and increasing advocacy.

Investments in optimizing the buyer journey digitally will pay off exponentially as buyers who develop stronger bonds also become better advocates and also buy more

Conclusion: A Call to Action for CEOs & Boards

The B2B buyer disconnect is not a challenge that can be solved with incremental changes or siloed initiatives. It requires a fundamental rethinking of how B2B companies create, deliver, and communicate value.

Boards must take an active role in driving this transformation:

Make the buyer disconnect a standing agenda item in board/exec meetings. Request an update on these issues from your leaders within the next 30 days

Demand comprehensive metrics that go beyond traditional sales and marketing KPIs to measure the entire buyer journey

Encourage significant investments in digital transformation that help companies reduce their dependance on a few superstar sales reps

Perhaps assign a mystery shopper who acts as a buyer and then engages with marketing and sales frontlines to give specific feedback on the experience

B2B companies that thrive in the AI world are those that can successfully bridge the buyer disconnect, creating recurring value that resonates with modern B2B buyers.